Magi Income Limits 2025. If you disagree with our decision. Medicare parts a & b.

Internal revenue service (irs)tax code, regulations and official guidance; Find what’s included in magi.

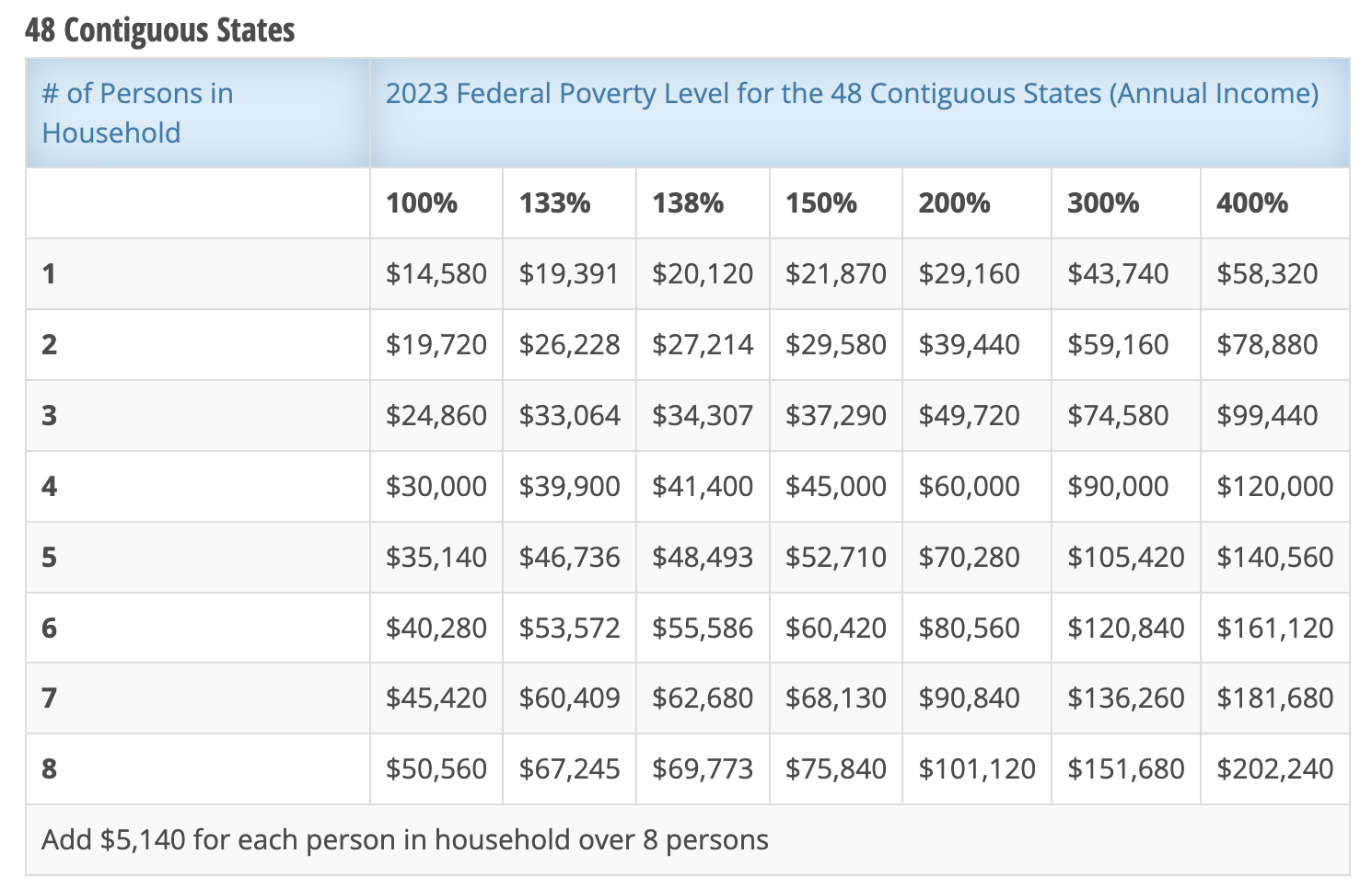

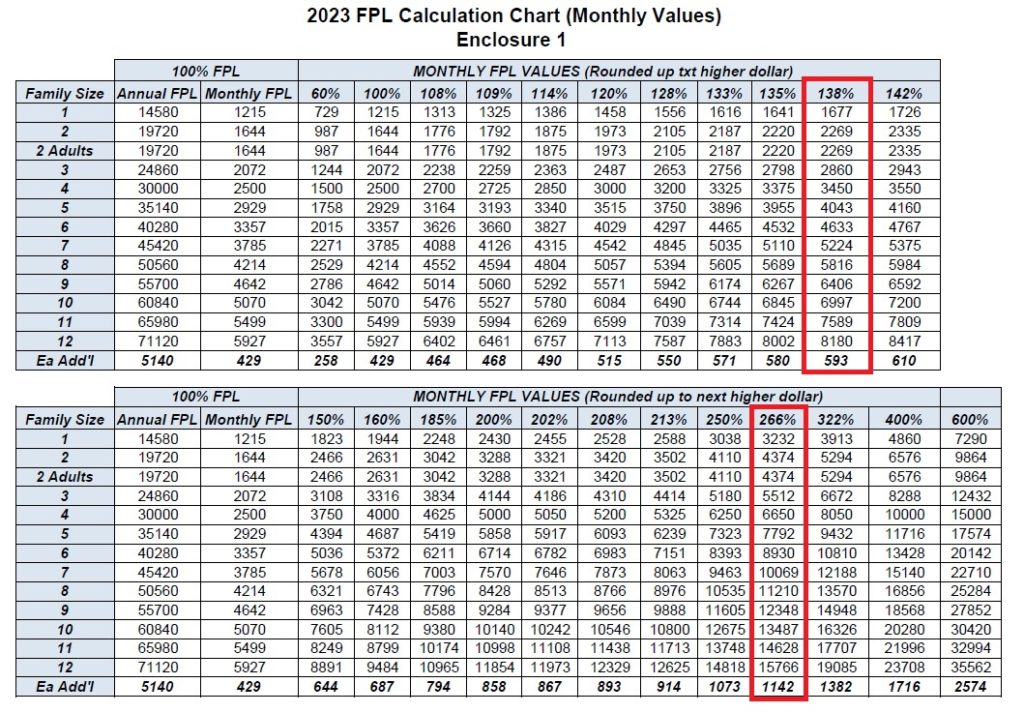

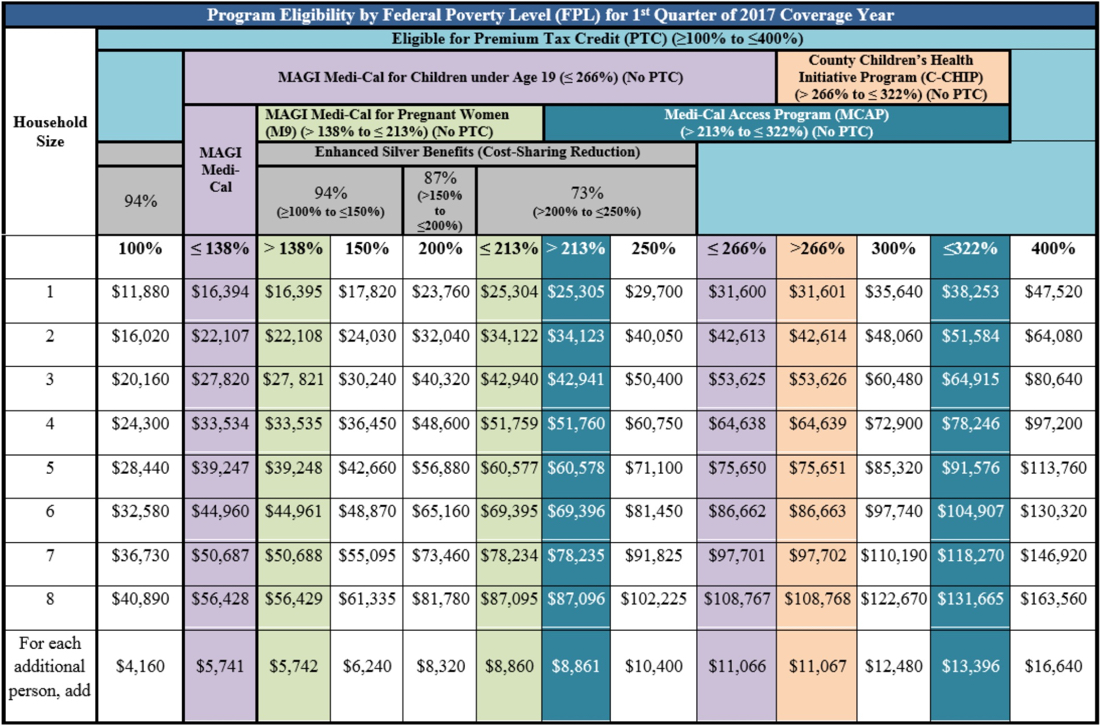

MediCal Qualification & eligibility Magi no asset test, This is the minimum magi income standard plus the 5% disregard used to determine eligibility for an individual whose income exceeds the minimum income. (effective january 1, 2025 to december 31, 2025 for magi programs, unless otherwise noted;

MAGI MediCal Eligibility For 2025 Increases Over 6, “once you hit that top end, you’re. For tax year 2025, the.

What Is Modified Adjusted Gross For Medicare?, Medicare parts a & b. Married filing separately if living with spouse at any point during the.

How To Calculate Magi For Medicare Premiums, Medicare recipients with 2025 incomes exceeding $103,000 (single filers) or $206,000 (married filing jointly) will pay a premium. 2025 income and resource limits for medicaid and other health programs.

What is Modified Adjusted Gross (MAGI)? Total Benefit, Since 2013, taxpayers have been subject to a surtax of 3.8% on certain net investment income if their modified adjusted gross income (magi) is over $200,000 for. If you disagree with our decision.

Ca 2019 Fpl Magi Mc Chart cptcode.se, If you disagree with our decision. Learn about adjusted gross income (agi), a number on your tax return that can help you calculate magi.

Michigan Pregnancy Medicaid Limits, The limit on annual contributions to an ira are $7,000 in 2025 (up from $6,500 in. Only a portion is refundable this year, up to $1,600 per child.

Marketplace Limits 2025, How to appeal the irmaa. Learn about adjusted gross income (agi), a number on your tax return that can help you calculate magi.

.jpg)

Roth IRA Limits for 2025 Personal Finance Club, The consequences of a high income on roth ira contributions. On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and.

USCIS Federal Poverty Guidelines for 2025 Immigration Updated, The income range is $30,000 to $120,000 in 2025 for a family of four. If income is greater than or equal to $397,000 the irmaa is.